The City of Newport Beach

Analyzing Unfunded Pension Liability with Scenario Planning

Introduction

Managing Pension Liability as a California Municipality

In California, monitoring and managing pension liability is crucial to the future solvency of every municipality. Each municipal government has a host of internal objectives, but if accomplishing those objectives is dependent on bonds, loans, or other forms of debt, then the city or town needs to be especially cognizant of its outstanding CalPERS pension liability.

During a recession, managing pension liability can become a scenario analysis nightmare. Declining market returns coupled with uncertain and unpredictable municipal revenue streams can place municipalities in precarious financial positions, especially in relation to their pension obligations.

The City of Newport Beach actively projects its financial future in relation to its discretionary and non-discretionary pension liabilities. Steve Montano, the City of Newport Beach's Deputy Finance Director, projects the City’s financial flexibility every year around CalPERS payments, recession scenarios, property taxes, and more.

Getting Started with Financial Planning

Financial Planning at the City of Newport Beach

Steve became Deputy Finance Director of Newport Beach over seven years ago, bringing a wealth of municipal finance knowledge to the affluent California city. One of those areas of specialty is financial forecasting for public entities.

Steve started out using traditional spreadsheet applications like Excel to model Newport Beach’s finances, but he quickly found that the program was inflexible and unstable when attempting to answer questions from the City’s Finance Committee.

He discovered that building out models that incorporated all of the City’s funds and financial variables caused excel to frequently crash, which meant he had to regularly save separate versions of the model to not lose any work. When he did answer questions with his model, he would spend hours checking and back-tracking results to make sure that errors had not propagated through the spreadsheet.

In an attempt to limit error propagation and build-in Newport Beach’s custom funds, Steve sought consultants that specialized in building Excel-based financial models. Due to the model’s complexity, Steve needed to identify a solution that solved for the rigidity and instability that was present. Steve searched for another solution that could adapt to the questions he was fielding from the City of Newport Beach’s Finance Committee, as well as project custom contingency funds and ratio analyses.

He quickly found that Synopsis was the only non-excel-based financial planning application designed for municipalities to explore their financial future over an unlimited number of scenarios. With its cloud-based accessibility and pre-mapped accounting, Synopsis offered Steve an error-resilient financial model-ing environment that could both model Newport Beach’s custom funds while layering in new prospective assumptions.

Modeling with Synopsis

Building a Comprehensive Financial Plan

Steve believes that many financial projections make the future look too sanguine because continuously com-pounding growth rates create unrealistic expectations for municipal revenue streams. With Synopsis, Steve was able to alter growth rates throughout Newport Beach’s 20-year projection, incorporating recessionary periods coupled with changing UAL pension payments to ultimately create a much more realistic model of the city’s finances. Unlike the excel environment he was used to, Synopsis allowed Steve to input layered growth assumptions without having to delete baseline assumptions or create new model versions.

Utilizing Synopsis’ non-destructive financial object layers, Steve created various financial scenarios to show the City’s Finance Committee the level of financial maneuverability Newport Beach had over different types of pension payments and economic conditions.

With a more comprehensive view of its future, the City could better analyze and inform key decisions for the City.

Annual Projection

Institutionalizing an Informed Budgeting Process

In 2018, the City of Newport Beach’s Finance Committee mandated the inclusion of a long-range financial forecast prior to the annual budget building process, as it helped frame the committee’s conversations in terms of future goals.

To open the 2019 annual meeting, Steve began with a review of historical trends, including how the municipality faired through the 2008 Great Recession. He wanted to show the Finance Committee that the City weathered the Great Recession without much economic strain, and would most likely experience similar prosperity if another recession struck.

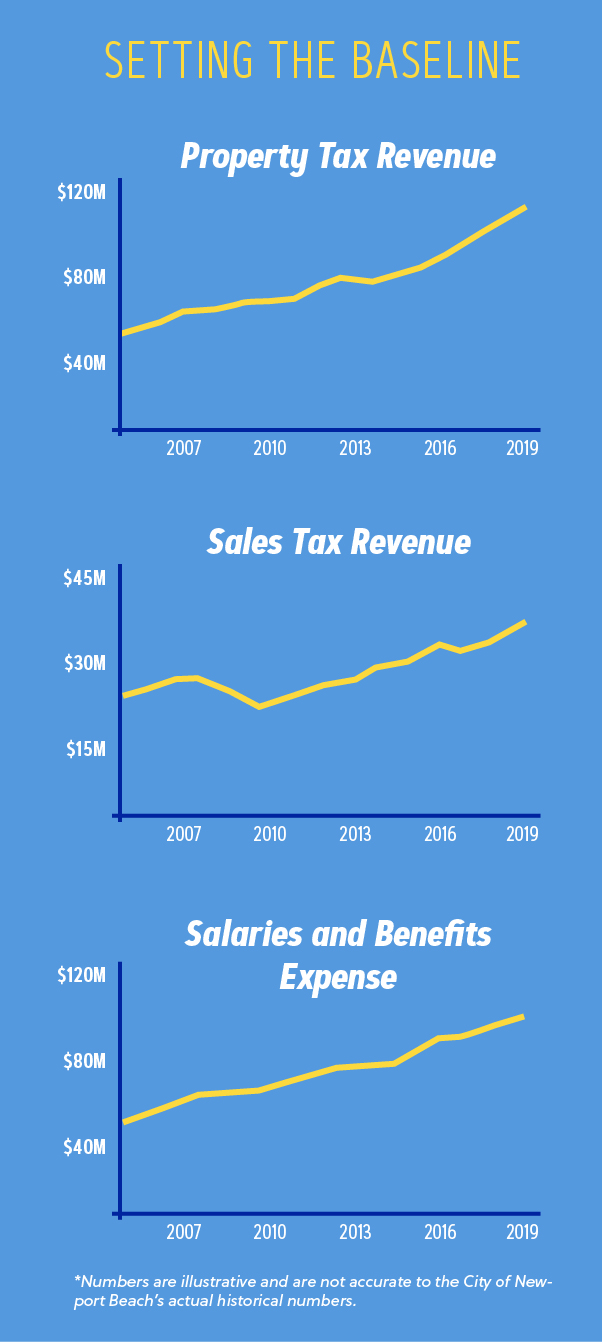

The first few slides of Steve’s presentation showed the 15-year historical revenue trends associated with property tax, sales tax, transient occupancy tax, and other general fund revenues.

Each municipal revenue source dis-played healthy compounded and aver-age growth rates that could be project-ed into the future. Similarly, the City’s expenses showed healthy growth in relation to general fund revenues.

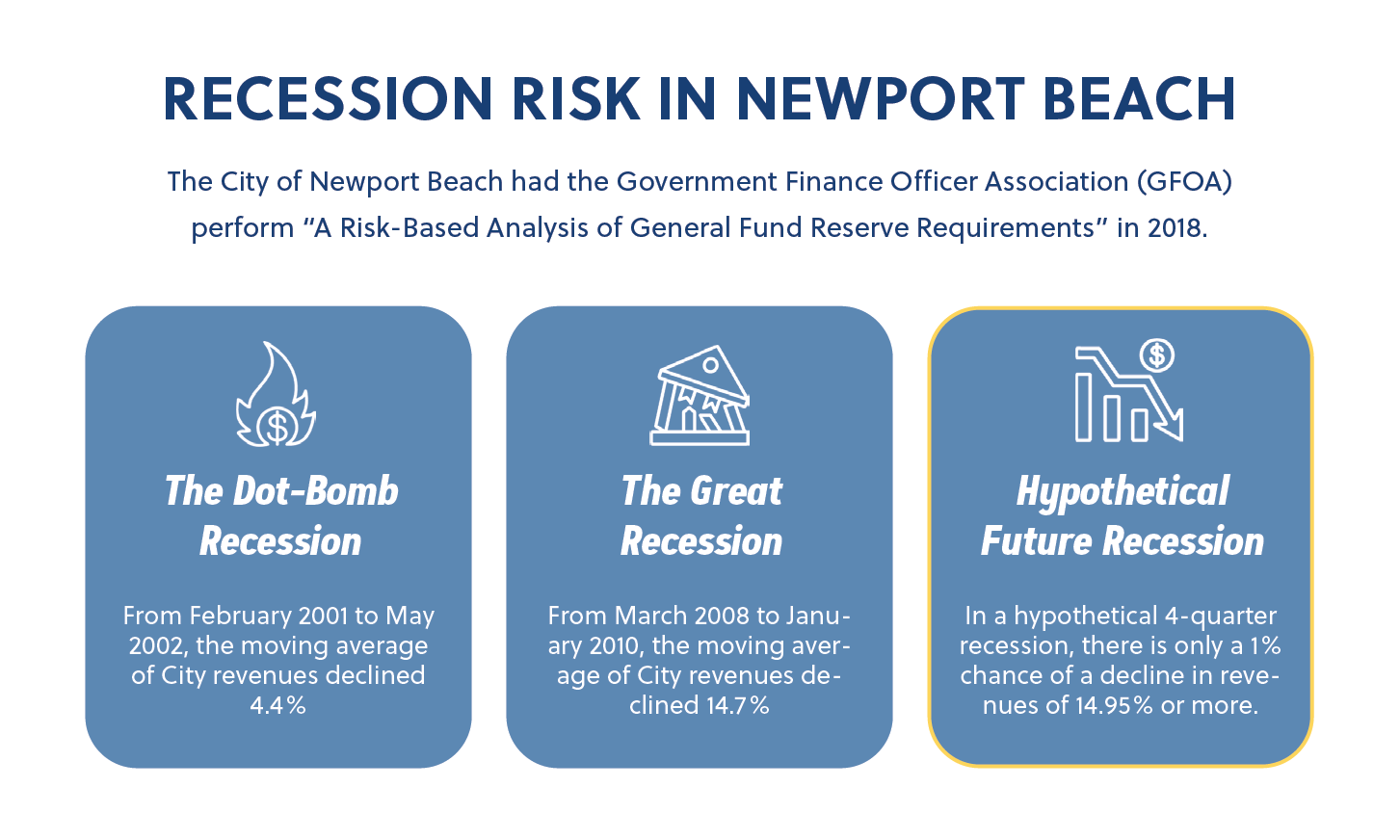

Steve then presented the historical effects of the Great Recession and the Dot-Com Recession on the City’s revenues. He showed that, although those recessions devastated other municipalities, the City of Newport Beach was able to weather both recessions without much impact to City service levels.

He also displayed findings from a 2018 Government Finance Officer Association (GFOA) analysis of the City’s general fund reserve requirements. The study confirmed that, if the City faced an economic downturn, it could last approximately 4-quarters but only had a 1% chance of revenues declining by more than 14.95%.

When he presented the GFOA findings to the Finance Committee, many members were worried that the City would not be able to support its operations or pay its pension obligations with such a drastic reduction in revenues. Steve quickly alleviated the concerns of the committee members by showing the various ways the City could cut spending while still fulfilling its unfunded actuarial pension liability (UAL) amortization schedule.With Synopsis, Steve was able to project the City’s financial health over a 20-year time-frame while including mild recessionary periods in FY23, FY30, and FY37.

Economic recessions, whether large or small, hit on average every seven years, so Steve changed Newport Beach’s revenue and expense growth assumptions for those years, decreasing them in accordance with historical recessionary trends.

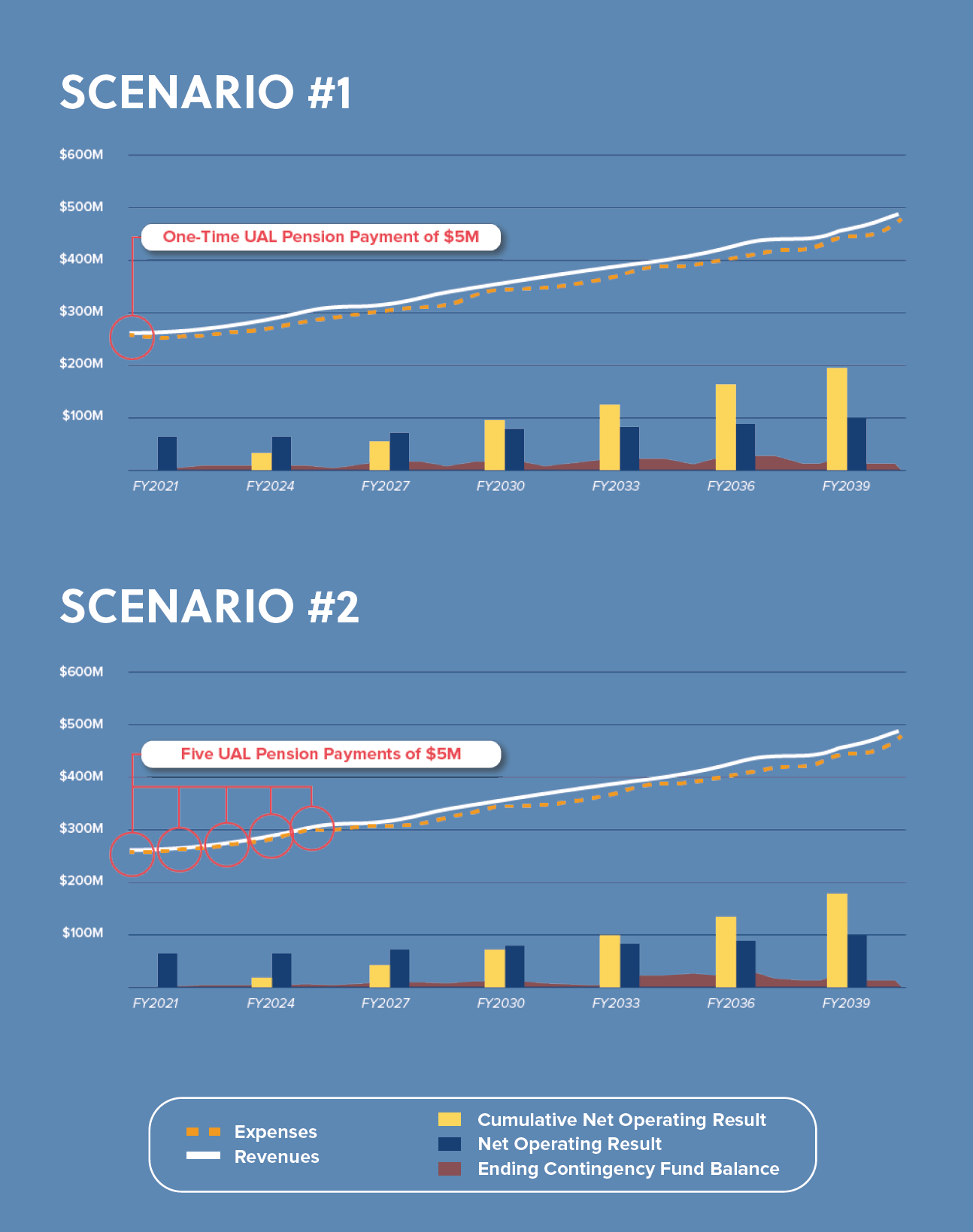

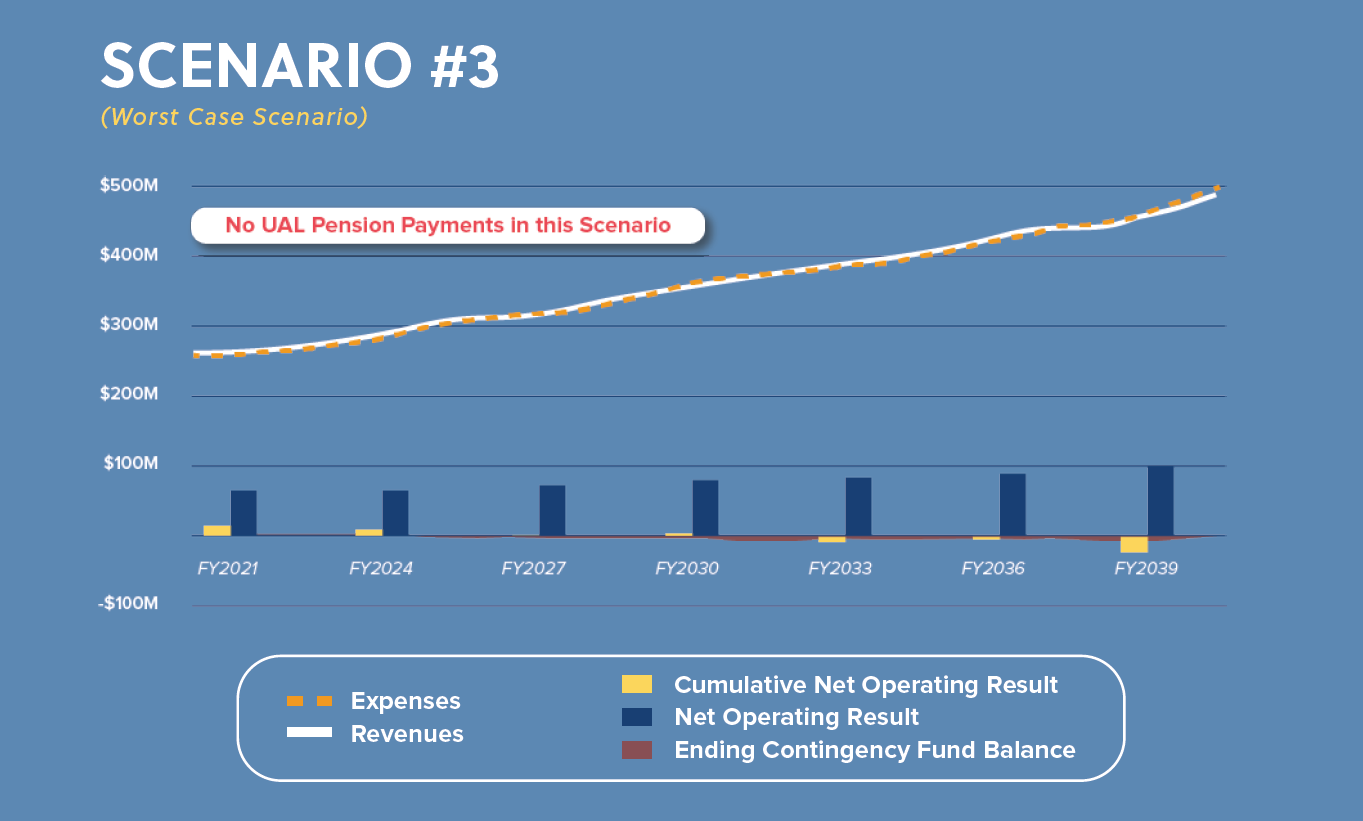

After creating a baseline projection of the City’s financials, Steve layered in multiple financial scenarios; two scenarios showing the City’s ability to pay additional discretionary pension payments and one “worst-case” scenario showing that the City could still pay its UAL amortization schedule even during an unprecedented recession. Steve’s scenarios can be broken down as follows:

- Scenario 1: Additional pension UAL contribution of $5M in FY21 during standard economic conditions.

- Scenario 2: Yearly additional pension UAL contributions of $5M between FY21 and FY25, including a mild recession in FY23

- Scenario 3: No additional pension UAL contributions beyond the current UAL amortization schedule and assumes no revenue surplus (worst-case scenario)

The first two pension payment scenarios were layered into the City’s expenses and the results showed that, given Steve’s economic assumptions, the City of Newport Beach could easily pay the additional $5M in UAL contributions.

Steve incorporated his analysis into an illustrative series of charts and graphs to give the City’s Finance Committee an easy way to understand that, although the City’s net operating result decreases slightly, it could maintain the discretionary UAL pension payments without touching its contingency fund balance.

The City of Newport Beach’s outlook is less bright when modeling Scenario 3. With expenses exceeding general fund revenues, the City’s cumulative net operating result maintains a deficit throughout the 20-year projection. To maintain the City’s operations, Steve spoke to what aspects of the City’s budget could be reduced and how discretionary pension payments could be deferred if the City encountered the economic hard-ships of Scenario 3.

Steve was able to construct and layer in this multi-variable scenario using Synopsis’s built-in modeling tools and features. By changing assumptions, editing municipal expenditures, and reducing city revenues, Steve created a worst-case scenario that he could save and layer into his singular financial model. In a spreadsheet environment, this would have been a painful if not impossible task; whereas in Synopsis, scenario creation and management is an out-of-the-box feature.

While he presented Scenario 3, Steve reminded the Finance Committee that this type of scenario is extremely unlike-ly and that it was created to show that the City could continue to function even through an absolute worst-case scenario. The GFOA analysis and the City’s historical revenues show that recessionary periods rarely impact the city’s finances for more than four quarters and do not completely remove the City’s surplus like in Scenario 3.

COVID-19 UPDATE

The City of Newport Beach hosted a webinar in partnership with GFOA titled Financial Decision-Making Under Uncertainty on March 27th, 2020. During the webinar, Dan Matusiewicz, New-port Beach’s Finance Director, reviewed financial maneuvers the City could perform to overcome economic strains related to the COVID-19 pandemic.

Matusiewicz presentation focused on how the City could maintain normal operations through expenditure cuts and capital project deferments, which reflected Steve’s analysis of Scenario 3 from the annual financial forecast meeting. By relating various financial cuts to different budgetary revenue thresholds, Matusiewicz showed how Newport Beach could combat the recessionary effects of COVID-19 without drastically impacting public services.

Although the Coronavirus pandemic could be defined as an unpredictable black swan event, the City of Newport Beach was able to quickly formulate a strategic response because the finance department had already analyzed and addressed worst-case scenario situations (like the Coronavirus) within the Synopsis software.

Conclusion

The Importance of Contingency Planning at the City of Newport Beach

Steve’s analysis inside of Synopsis and subsequent presentation of Newport Beach’s financial future showed that the City was well prepared for an economic downturn, even while proactively contributing to its UAL pension payments. Actively paying down the City’s pension liability is especially important during economic downturns.

As the COVID-19 pandemic cripples the global economy and US market returns decline, California municipalities will need to contribute more to address the increase in their unfunded pension liability. At the conclusion of Steve’s presentation, he believed that, through his analysis using Synopsis, the city needed to lower its expected market returns from 7.5% to 6.5%, which means that they need to contribute more to the City’s CalPERS pension fund.

Even with proactive pension payments, Steve’s model showed the City’s Finance Committee that they could continue to confidently support the city by allotting additional revenue surplus to community and infrastructure projects over the next 20 years.

Steve’s ability to incorporate economic downturns, pension payment scenarios, and custom funds into his Synopsis model led him to propose using Synopsis in other Newport Beach finance departments. The yearly budget-building process is one area specifically that he and the budget director think that Synopsis could help in creating different scenarios to adjust fund balance to different departmental needs. Recent enhancements to the Synopsis product will allow Steve to simultaneously compare multiple budgets and actuals, as well as any number of individual budget requests, while analyzing their respective long-term financial impacts against one another.

With the City of Newport Beach’s financial future explored, Steve and the Finance Committee are confident that their City can weather economic downturns while still contributing to their largest liability, and they look forward to exploring additional aspects of their finances using Synopsis.