In a best case scenario, local government officials are able to maintain a stable set of public services throughout an entire economic life cycle. However, without the ability to raise revenues, where does that excess capital originate?

The answer is most often by drawing down on an existing fund balance.

Learn what constitutes an appropriate fund balance and the benefits of maintaining accessible funds in this Synopsis whitepaper.

Introduction

To ensure your government is ready for a recession, and for adopting sound fiscal policy in general, ask yourself:

What is an appropriate level of fund balance to maintain?

Once an economic downturn hits, there is a limited ability to raise revenue. Difficult economic conditions are the last type of environment where your municipal government would want to (or be able to) raise taxes or other revenues that would put a further burden on the surrounding community. In addition, expenditure reductions can be equally difficult, as your workforce is experiencing the same challenging economic conditions.

Meanwhile your community is even more dependent on the essential public services offered by your local government, further stressing the expenditure side of the budget.

In a best case scenario, local government officials are able to maintain a stable set of public services throughout the entire recession life cycle. However, without the ability to raise revenues, where does that excess capital originate?

Fund Balance Definitions

The answer is by drawing down on an existing fund balance. That is why it is critical to have a strong fund balance approach.

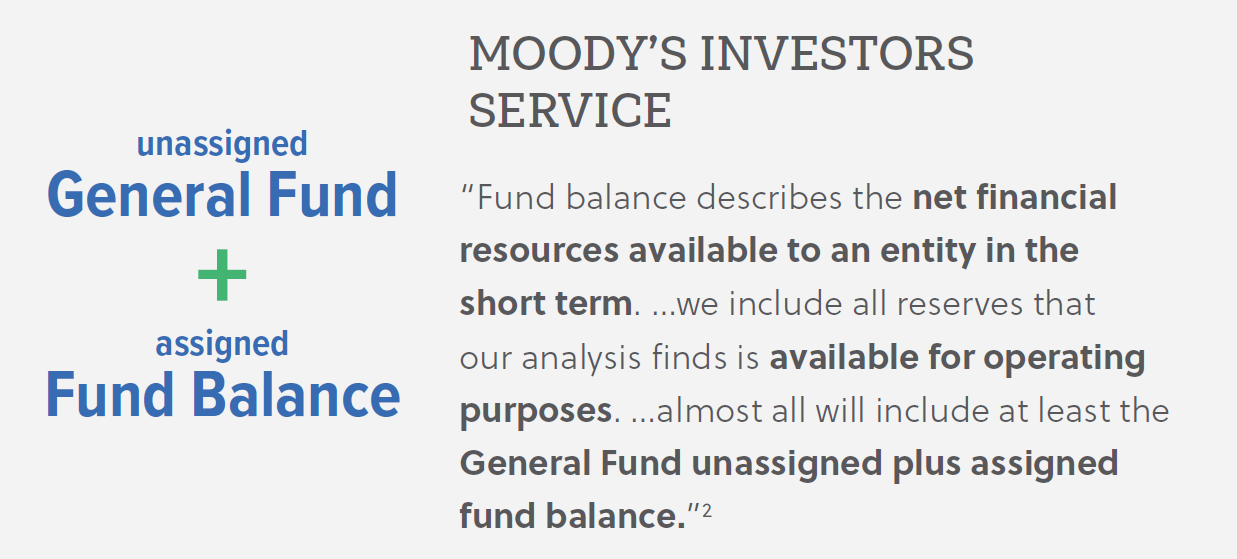

By its most basic definition, “fund balance” is simply the difference between assets and liabilities. However, many local government finance professionals see fund balance as much more complex and divisive. There are multiple definitions from a variety of reputable sources ranging from static and simple to dynamic and elaborate.

Ultimately, the definition and appropriate level of fund balance a government needs to maintain and where it should be categorized will depend on multiple factors. Below are three definitions from major industry thought leaders in public finance.

Fund Balance Definition By Industry Leaders

1. “Statement No. 54. Fund Balance Reporting and Government Fund Type Definitions”. Governmental Ac-counting Standards Board. https://gasb.org/resources/ccurl/313/494/GASBS%2054.pdf

1. “Fund Balance Guidelines for the General Fund” Government Finance Officers Association. www.gfoa.org/fund-balance-guidelines-general-fund

2. “Rating Methodology: US Local Government General Obligation Debt”, Moody’s Investors Service. Septem-ber 27, 2019. p.10 - 15. www.moodys.com/researchdocumentcontentpage.aspx?docid=PBM_1191097

Maintaining a Fund Balance

All governments are subject to risk, although the nature of those risks may vary with region, population size, economic profile, etc.

Maintaining appropriate fund balance is one of the most important ways a community can mitigate risks.

Maintaining a strong fund balance can be critical in weathering an economic downturn, emergency capital repairs, or volatile revenue or unexpected expenditure.

Many governments use unassigned fund balance and other unrestricted resources to fund capital improvements, avoid debt service costs, and increase their ability to cash flow fund a project during construction.

Fund balance is a focal point of credit rating agencies and investors; when governments maintain more fund balance, they are viewed more favorably and can achieve lower borrowing costs.

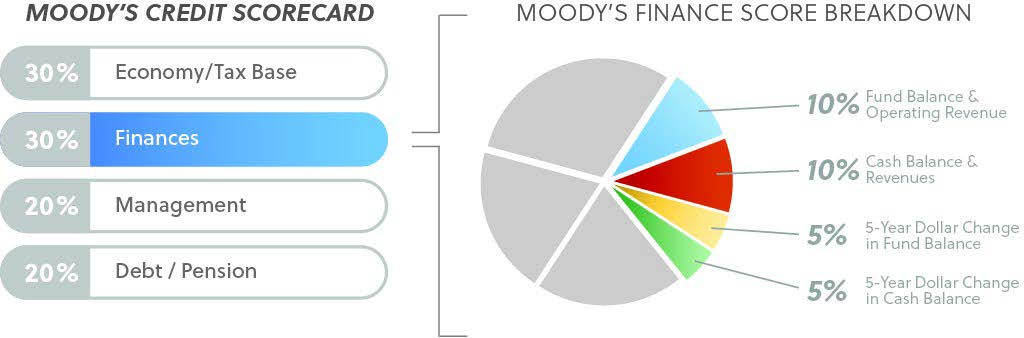

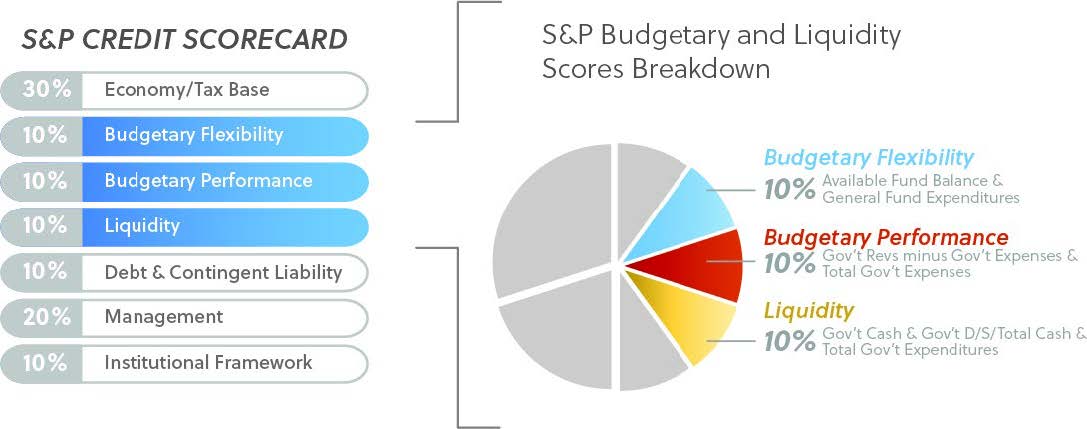

Rely on Moody’s and S&P Rating Methodology as a Framework

A well maintained fund balance is critical to credit rating thought leaders like Moody’s Investors Service and Standard and Poor’s.

30% of Moody’s Rating Methodology Determined by Fund Balance

Source: “Rating Methodology: US Local Government General Obligation Debt”, Moody’s Investors Service. September 27, 2019.

30% of S&P’s Rating Methodology Determined by Fund Balance

Source: “US Local Government General Obligation Ratings: Methodology and Assumptions”. Standard & Poor’s Rating’s Services. September 12, 2013.

Fund Balance Analysis

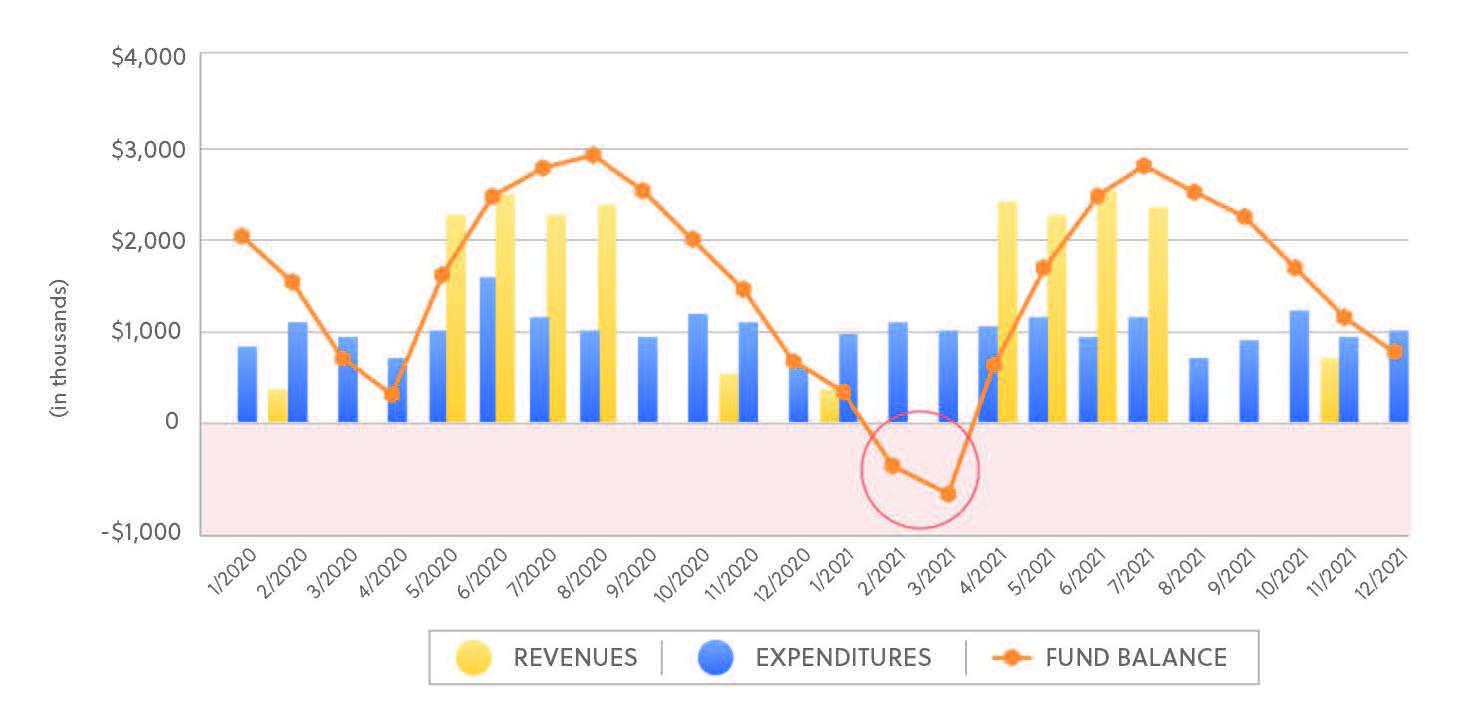

FUND BALANCE COVERS EXPENSES

Most governments depend on revenues collected during a single period, but have consistent, year-round expenses. Revenue collections for major sources (i.e. property tax) may come at specific points in the year, and the fund balance may be strained before these collections arrive.

When liquidity is under stress, governments may issue short term financing to cover the gap, requiring an interest cost to maintain steady operations and introducing risk in accessing the market.

Adequate fund balance negates that need, saving resources that would otherwise be spend on servicing the costs of that debt.

EXPENSES EXCEED FUND BALANCE

But how much should you maintain - again, it depends on who you ask. Rating agencies use their own methodology generally based as a % of a governments’ annual revenue and expenditure.

The Government Finance Officer Association (GFOA) indicates that no less than 2 months of operating revenue or expenditure denotes a healthy fund balance. However, local stakeholders will ask why they continue to pay taxes if there is any unassigned fund balance outstanding at all.

According to the published local government rating mythology from Moody’s Investors Service, a fund balance between 15% and 30% of revenues is needed to receive a scorecard value of “Aa”.1

1. “Rating Methodology: US Local Government General Obligation Debt”, Moody’s Investors Service. Septem-ber 27, 2019. p.13. www.moodys.com/researchdocumentcontentpage.aspx?docid=PBM_1191097

“The strength of a given level of fund balance varies depending on the particular local government and its respective operating environment. Larger balances may be warranted if budgeting revenues are economically sensitive and therefore not easily forecasted, or to offset risk associated with tax base concentration, unsettled labor contracts, atypical natural disaster risk, and pending litigation. Alternately, municipalities with substantial revenue-raising flexibility may carry smaller balances without detracting from their credit strength; this weakness is offset by their ability to generate additional resources when necessary.”

“Rating Methodology: US Local Government General Obligation Debt”, Moody’s Investors Service

Moody’s also comments that a local government’s general operating budget will help guide their viewpoint of an appropriate amount of fund balance.

Besides the published methodology, Moody’s also publishes median values for certain metrics, including fund balance ratios, that could be helpful to isolate a target cohort of comparable entities.

Ultimately rating agencies place a heavy focus on fund balance amounts and if local governments are placing a priority on maintaining or improving their credit rating, using values put forth in the included rating methodologies could provide valuable guidance.

Fund Balance Benefits

How can your government, specifically, benefit from maintaining fund balance?

Enable your public services to maintain stability during economically cyclical revenue fluctuations.

Maintain flexibility on capital financing options.

Strong liquidity is viewed favorably by rating agencies, and can result in lower borrowing rates.

Stable reserves can allow for a more long term view of planning, where near-term liquidity needs aren’t crowding out the dialogue for a strategic, sustainable plan.

Example Policy: Minneapolis

Maintains 15% of the revenue budget in unallocated General Fund balance. Funds in excess are used to “avoid cash flow interruptions, generate interest income, avoid the needs for short-term borrowing, and assist in maintaining a triple-A bond rating.”

“Available fund balances shall not be used for ongoing operating expenditures, unless a determination has been made that available balances are in excess of required guidelines and that plans have been established to address any future operating budget shortfalls. Emphasis shall be placed on one-time uses that achieve future operating cost reductions. Fund balance is the cumulative years’ excess or deficit of all revenues and expense… “

Source:http://gfoa.org/sites/default/files/u63/GFOAFinancialPoliciesDoc4EMinneapolisPolicy.pdf

Example Policy: Gwinnet County

Gwinnet County keeps a minimum balance of reserves is 3 months of expenditures. If there are excess reserves they may be used for:

“…accrued liabilities, including but not limited to debt service, pension, and OPEB.. Priority will be given to those items that relieve budget or financial operating pressure in future periods.”

“Appropriated to lower the amount of bonds or contributions needed to fund capital projects in the County’s CIP.”

“One time expenditures that do not increase recurring operating costs that cannot be funded through current revenues…”

Start-up expenditures for new programs, provided that such action is approved by the Board...”

Source: http://gfoa.org/sites/default/files/u63/GFOAGeneralFundOperatingReservePolicyexecuted.pdf